In today’s uncertain economy, having a financial safety net that grows with you is more important than ever. IUL gives you stability, security, and financial confidence—all in one powerful package.

Ready to take control of your future? Let’s talk about how Indexed Universal Life can work for you.

Offering long-term death benefit protection with interest credited based on the performance of a market index.

Grow Your Wealth – Benefit from market-linked growth potential with downside protection. Your cash value earns interest based on an index’s performance, but with built-in floors to protect against losses.

Enjoy Tax Advantages – Your policy’s cash value grows tax-deferred, allowing you to act as your own bank. You can access funds tax-free through policy loans, providing a strategic way to manage wealth efficiently.

Build a Legacy – Secure your family’s financial future with a permanent death benefit while maintaining control over your wealth.

Flexibility on Your Terms – Adjust premiums, access cash when needed, and tailor the policy to your evolving financial goals.

In the world of financial planning and retirement security, guaranteed income annuities stand out as a reliable solution for those looking to secure a steady stream of income for a specific period.

1. Predictability and Security – One of the most attractive features of a Fixed or Indexed Annuity is the certainty it provides. Knowing exactly how much money will arrive and when allows for better financial planning without the concern of market fluctuations affecting payouts.

2. Customizable Duration – Annuities offer flexibility in choosing the payout period. Some individuals prefer a shorter duration for larger payments, while others opt for a longer term to ensure steady income over an extended period.

3. Protection Against Market Volatility – Unlike other financial options that may be influenced by market changes, Fixed or Indexed Annuities provide a guaranteed payout structure. This makes them particularly appealing for those who prioritize financial stability over high-risk opportunities.

4. Potential for Beneficiary Payouts – In some cases, annuities can be structured to include a beneficiary option. If the annuitant passes away before the term ends, the remaining payments may be transferred to a designated recipient, ensuring that the remaining value does not go to waste.

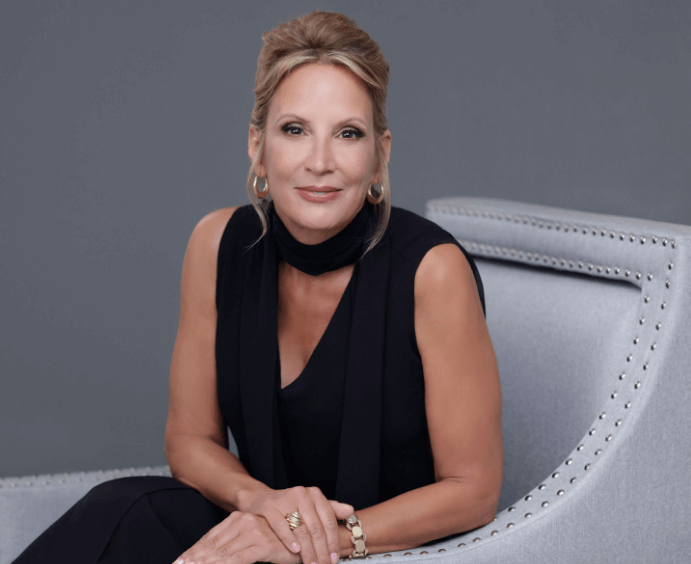

Backed by years of valuable experience, industry certifications, industry-leading insights, and our advisors bring a wealth of knowledge to help you navigate every stage of life.

5266 NE 6th Ave #28H Fort Lauderdale, FL 33334

Email: Beth@EONWealthGuard.com

Phone: +1 (561) 331-1148

Florida Department of Financial Services License

A275852

NPN 543214

EON Wealth Guard, 2025. All rights reserved. Designed by Rebel Haus.